Intellectual property represents an important financial and legal asset for companies, including startups. It is often estimated that intellectual property counts for more than 80% of company’s value. For investors, companies with solid intellectual property portfolio are attractive investment targets. Here are 5 simple reasons why that is.

1. Intellectual property has no limit on its value

Unlike most asset classes, the value of intellectual property can increase indefinitely. If a company owns a factory, its value is fixed and, if anything, likely to depreciate in the future. A factory requires repairs, maintenance and renewal of machines, etc. Intellectual property protects whatever value there is in the company (brands, innovations, design), and also contributes to its increase.

The value of trademarks (which protects the brand) is largely determined on how well the company does. For example, according to Forbes, the brand value of Apple is nearly 150 Billion euro and has been increasing significantly in the last 10 years. There is no external limit on how high that can get regardless of the size of the company. Even better, according ISO standard 10668:2010, registered trademarks not only protect the existing value in the brand but also contribute to its increase as well.

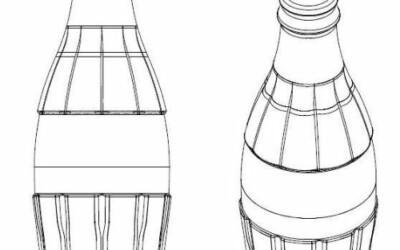

Many aspects of brand’s value can also be protected and captured through design registrations. For example, for many consumers, product design is one of the most crucial and recognisable aspects. Making sure it is legally protected increases the value of the business.

Patents can have significant intrinsic value that is not even dependent on the performance and perception of the company or its product on the market. Good inventions that are protected by strong patents will be useful (and therefore valuable) at least to somebody, which brings us to the next point.

2. Intellectual property can be leveraged in many different ways

Rovio, the creator of Angry Birds makes over 20% of the company’s revenue with licensing and many smaller companies do the same. We represent many startup companies whose business model is essentially about licensing their brand, technology or both of them. Licensing is not only for big companies, it can be a very profitable business model for startups as well since there are very little costs involved. Patent licensing does not even require a famous brand behind it, only that the technology (invention) is good and well protected. Intellectual property portfolio can also be used as collateral for obtaining different types of financing.

When money is invested in creating and protecting intellectual property, there is a good chance that those investments can be recouped in many different ways. Intellectual property can also be sold like other property.

3. Intellectual property portfolio reduces operational risks

Apple had to pay $60 million for the iPad trademark in China because another entity had registered it first. Intellectual property works on “first to file” basis (whoever protects it first gets the rights). By protecting the brand name in important countries you can ensure that nobody else gets better rights to the name in those countries. Changing a brand name even in one country is a costly operation, not to mention losing the investments already made in promoting the brand. This kind of risk hanging over a company’s head makes it less attractive as an investment target. Although there are trademark trolls particularly in China, in most cases conflicts are a result of unfortunate coincidence. There are over 20 thousand trademarks registered every day, so the chance that somebody will think of a similar name is quite high. It is important to protect your intellectual property at least in the most important countries as early as possible.

Protecting brand, innovation and design of the product with intellectual property rights in major markets creates a basis for scaling business quickly and extensively – a good reason for investors to love intellectual property rights.

4. Companies that protect intellectual property seem more trustworthy partners

A company that does not protect its investments (brand building, innovations) is hard to take seriously. Not protecting intellectual property also put partners (resellers, distributors, etc.) in a difficult position. For example, a reseller might not be a very motivated partner if infringing products are being sold for knock-off prices and there is nothing that can be done to prevent that. So by protecting intellectual property companies are also protecting their business partners’ interests and thereby attracting higher quality partners. A recent study covering over 2000 European small and medium sized companies found that “value and image” was the third most important reason for protecting intellectual property. Furthermore, 60% reported that the impact of protection was either positive or very positive. Only 1% reported the impact being negative or very negative.

5. Intellectual property rights boost your marketing and sales

Even if you are not (yet) interested in the value of your business or brand but just want to sell your products, intellectual property also works as a marketing tool. The ® symbol informs the public that the brand owner believes in the product and does not want competitors to ride on its reputation. “Patent pending” statements in marketing give a message about the product’s innovativeness. By indicating that the appearance of the product or its detail is a protected design you make it clear that the product represents increasing individuality and stands out from the mass. These messages appeal to customers and investors know.